While the eyes of the investment

community were focused on Jackson Hole last week, where Chairman Bernanke was

expected to give hints whether or not the Fed would undertake additional

measures to catalyze the near comatose U.S. economy, a similarly important

question was also quietly being bandied about: What would the Chinese do? China’s

annual growth has slowed to 7.6%, below the government-mandated 8% threshold

for the first time since 2009. At the same time, inflationary pressure has been

reeled in, providing room for authorities to undertake additional stimulus.

Such a step would be of relevance given the role China’s accommodative policies

played in buttressing the global economy during the height of the financial

crisis. The question of additional action arises as both the country’s official

and HSBC’s version of the PMI index show the manufacturing sector has entered

into contraction territory.

Rather than delve deeply into the

arcane world of economic indicators, a more prudent use of this space is to go big picture and identify the many

channels through which China already impacts the U.S. and other western

economies (some obvious, others more subtle). Due to its growing influence on

the global stage, several pundits have already labeled the 21st

century as the age of China, much as the last one belonged to America. But

rather than get caught up in the hype….especially prevalent in financial

markets….of China’s inevitability, one should look beyond raw economic growth

for potential headwinds. Paradoxically, it is this rapid growth that has

exposed the country to a host of possible hurdles that its political and social

structures are ill-equipped to handle.

So Much More Than Cheap Shoes (And iPhones)

Take an informal survey on China

and most Americans would reference its epic growth rate, role as the world’s

factory and possibly the sizable chunk of U.S. government securities in its

possession. With regard to the linkages between China and the U.S., the latter

point is a good place to start. As we will continuously be reminded during the current

election cycle, America is the world’s largest debtor nation. While the private

sector deleverages, public coffers continue to expand. China accounts for 22%

of outstanding, foreign-held federal debt ($1.16 trillion). It does not invest

in Treasuries for their juicy returns (the 10-year benchmark currently yields a

laughable 1.57%), but instead because the U.S. government debt market is the

largest, most liquid and (supposedly) safest in the world. Over the past decade-plus,

such bond demand has suppressed U.S. interest rates, which in turn have spurred

Americans’ purchases of Chinese-made goods. The profits from these exports get

reinvested into more Treasuries, further suppressing rates….and the cycle

continues. As any first-year finance student learns, portfolio diversification

is a good thing, and the Chinese have not been good diversifiers. That has created

a situation that former Treasury Secretary Lawrence Summers calls The Balance of Terror. Ignoring for now

the Fed’s recent role of marginal-buyer of U.S. debt, Treasury prices depend

upon continued appetite by the Chinese. The rub is that they already own

one-fifth of the foreign-held outstanding amount. Any hint that they plan to

trim this massive exposure will send other Treasury investors running towards

the exits, hammering the value of bonds and catapulting yields through the

roof. Likely the worst affected party….aside from U.S. borrowers…would be the

Chinese as the value of their Treasury portfolio would plummet, the dreaded balance about which Dr. Summers warns.

The recycling of Chinese export

profits into Treasuries is not the only way China has impacted U.S. interest

rates. The relocation of much of the world’s manufacturing base to low-wage

countries like China resulted in a disinflationary

environment, meaning a period which saw annual inflation rates drop from the

4%-5% range to the neighborhood of 2% by the early/mid 2000s. Without upward

price pressure, the Fed was able to keep interest rates low in hopes of

spurring credit-fueled economic growth. And it worked…..well, until the worst

financial crisis in 80 years. Hindsight is 20/20.

The disinflationary impact of

China on the U.S. consumer is evidenced in the August 21st post,

which shows that prices for the goods most associated with Chinese exports

(apparel, electronics) exhibited minimal upward pressure, or actually fell,

over the past decade. Alas all good things must come to an end. Factory wages

have begun to rise and China is attempting to climb up the value-added food

chain. Already certain industries have relocated manufacturing capacity to

lesser developed, even lower cost Asian nations. China’s push towards more

sophisticated products is meeting with some success (where do you think the

iPhone is assembled?), but this foray will present challenges to western firms,

who don’t wish to share their closely guarded intellectual property with

Chinese partners for (valid) fear of getting ripped off.

“Got Any Spare Iron, Copper or Soybeans We Can Buy?”

China’s entry into the global

economy may have initially contributed to lower inflation in developed markets,

but that has given way to the country likely being a net contributor to upward

pricing pressure due to its massive demand for a range of industrial inputs. Not

only do China’s export-focused factories require raw materials, but so do the

country’s leviathan infrastructure projects, some of which have been pushed

forward in the name of stimulus. Already China is the largest user of a range

of industrial metals including, iron, copper, zinc and aluminum. Despite it

being the top producer of several of these metals, China is also the leading

importer, which has direct ramifications on global markets. And what has occurred with metals is being

repeated with energy commodities. While the U.S. remains the leading consumer

of crude oil, accounting for 20.5% of global demand, China has reached second

place with an 11.4% share. Similar to America, China only produces about

one-half of its domestic demand and must import the rest from global markets,

competing with America in the process.

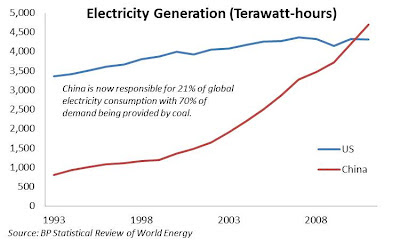

As seen in the chart below, when

including all sources, China recently surpassed the U.S. as the largest energy

consumer. What it lacks (for now…..it’s changing) in crude demand, it more than

makes up with demand for coal. China accounts for nearly 50% of global coal

consumption. Coal accounts for 70% of the country’s electricity generation,

compared to less than 50% for the U.S. (a fact attributable to recent increased

natural gas production).

The upward price pressure put on industrial….and

agricultural…commodities by a rapidly industrializing China is not the only way

the country is impacting global consumers. In addition to pumping out

freighters full of goods of varying quality, Chinese factories also have

another output: pollution….and lots of it. Hand-in-hand with its position as

the world’s leading energy consumer, China now tops the charts as the greatest

emitter of carbon dioxide. Granted on a per capita basis, it is substantially

less energy intensive and polluting than industrialized nations like the U.S.,

but that is really another red flag. As automobile ownership increases and the

aspiring middle-class wants more electricity-driven gadgetry, per capital usage

and pollution will only grow. This impacts the rest of the world because discharging

emissions into the Earth’s atmosphere is like urinating in a swimming pool.

There is no special lane in which effluent stays.

A Bear in The China Shop

China’s growth rates are reason

alone for investors to seriously consider gaining exposure to the country. Even

the current soft spot towers over

European and American growth. Some naysayers state that Chinese data is not to

be trusted so how do we know the actual state of the economy? If one

amalgamates various official and private data, a mosaic arises that should at

least infer a general trend. But that is splitting hairs. The truth is China

remains the largest country in the world and authorities are doing everything

in their power to catch-up with advanced economies. All one need to do is show

up to realize the frenetic pace of growth and opportunity that remains. Three

to five years out, exposure to China-related investment themes is a no-brainer.

Farther down the road, question marks begin to arise.

Wasn’t Central Planning So 20th Century?

First among these is the fact that

China is a totalitarian regime and thus comes with all the baggage that history

tells us such governments carry. Some currently argue that China’s centrally

planned, edict-driven economy (“grow at this pace,” “build that massive

apartment block,” “lend to that state-run enterprise”) shows an alternative to

the chaotic free-enterprise system practiced by the Anglophone world. In this

respect, China is like a France, only larger and without foie gras. But such

control inevitably leads to cronyism and corruption. These regimes lack the

tools of a civil society such as an independent judiciary, solid contracts, a

nosey press and the rights for stakeholders to speak up. Without these checks, anointed

bureaucrats can comfortably continue their labors either in complete ineptitude

and/or with a lack of ethics. Centrally planned economies also quash the animal spirits necessary to fuel

entrepreneurialism and innovation. Despite China’s emphasis on math and

science, the country is a laggard in registering international patents. The educational

level…and critical thinking ability (you really think the government encourages

that skill?)…of its legion of engineers still lags behind those of its western

peers.

By suppressing all forms of

expression, except for the pursuit of material goods (plenty of rich people

there) the central authorities have inadvertently put themselves into a tenuous

position. As other authoritarian countries have allowed a middle class to germinate,

citizens begin to demand greater accountability in government, stand up to

bullying and corruption and expect to gain a voice in the nation’s future. On

the other side, one of China’s richest woman, Zhang Xin, boldly stated that the

working poor…the vast majority of the country…only have one aspirational outlet,

which is to gain the few creature comforts that others have already attained.

Should the government not be able to deliver on its promise of growth, then the

masses may not live up to their end of the bargain of not complaining about of

political repression and corruption. If anything keeps the powers in Beijing

awake at night, it’s this social unrest scenario.

Favorable Demographics? Not So Fast….

It may come as a surprise to the

casual reader, but despite its size, demographics are not in China’s favor. As

a consequence of its one-child policy, the working age population will soon

start to shrink, especially in relation to the ranks of the retired. This

creates a massive headwind for the country’s desire to increase domestic consumption.

Ironically China has an abysmal social safety net with much of the cost born by

families. In that sense, the country has all the bad stuff associated with a

communist state (iron-fisted control, human rights abuses, cheesy military

parades and septuagenarian leaders) without any of the good stuff promised by

Messrs. Marx and Engels (a workers’ utopia). With the expectation that they

must care for the elderly, younger Chinese may to pile much of their earnings

into rainy day funds rather than spend freely on creature comforts.

The Brown Cloud (And Brown Water)

Lastly, one cannot overstate the

damage being done to the country’s environment and consequently the health of

its citizens. As mentioned earlier, China is already the world’s top emitter of

carbon dioxide. Water quality…or lack thereof…is not far behind. The

ramifications for demographics, worker productivity and healthcare spending are

consequential. A crisis in the making such as this would not only impact the

global economy by diminishing China’s contribution to growth, but pollution

being pollution…and all of us stuck on the same sphere of rock air, and water…other

countries could feel the fallout from its dreadful environmental record.

No comments:

Post a Comment