On this election eve it is all

too tempting to delve into policy nuances of the competing camps vying for

control of the world’s largest economy. But that runs the risk of being perceived

as taking a political stand, which is not the purpose of these pages. Not to

mention, as many a pundit have already stated, if one is only now researching

issues such as the economy, do the country a favor and don’t vote (a statement

which lands me in hot water for seemingly discouraging the franchise). To play

it safe, we’ll instead impartially take shots at all political sides, and for

good measure, expand our assault to policy makers in other countries as well. The

subject that enables us to launch such a wide-ranging critique is none other

than the structure of the economy, namely the system regarded as the victor in

the past century’s battle for global supremacy: free market capitalism.

Rather than attack the shortcomings

of the free market, we posit that it largely does not exist, not only in

mercantilist and/or authoritarian emerging countries such as China and Russia,

but also in the world’s advanced economies. The readers of these pages have

been exposed innumerable times to the concept of market distortions, both in the real economy and in financial

markets. Some of these phenomena are the product of explicit government policy

while others are the (insert our favorite phrase) unintended consequences of policy makers’ measures to combat crises

and other (real and imagined) economic ills. Regardless of the origin, distortions

have become so pervasive in the global economy that one could argue that

possibly outside of the barter system practiced in a yet-to-be discovered aboriginal

Amazonian society, the free market exists in name only.

The Efficient Beauty of Chaos

As the economic heavyweights have

taught us, there is no greater incubator of innovation than an unencumbered

market that enables buyers and sellers to come together to match needs with

solutions and supply with demand. Hayek aptly described this amorphous meeting

place as both chaotic and ingenious. When left to their own devices, the

experimentation, imagination and entrepreneurialism of market participants are peerless

in their ability to create products and services that enhance society’s productivity

and well-being. Sometimes the market conceives of products that we were not

even aware we needed, such as organic omega-3 fortified flaxseed wafers,

Frappuccinos and Angry Birds. Our favorite Austrian (sorry Arnold) also

explained that no centralized entity could come close to replicating the efficiency

of thousands of established and potential transactions among buyers and

sellers. The mechanism the market uses to prescribe value to a product or

service and to channel finite resources to their most effective/profitable use

is prices.

But often the pricing mechanism

can render verdicts considered unfavorable to the powers-that-be, either in the

name of fairness, or…more often than not….due to them controverting established

policy narratives or subverting the interests of the status quo. In order to

override judgments meted out by prices, authorities rely upon an arsenal of

tools, some overt some subtle. Whatever the instrument, the result is the same;

distorted markets are those where underlying supply, demand or costs have been

altered in a manner that pricing signals are different than what would have

occurred in an unfettered market.

To see evidence of the

distortions impeding pricing mechanisms, one only need glance at the headlines

of the financial press, cruise down a supermarket aisle, or…if wearing a sturdy

raincoat…visit a photovoltaic solar farm in soggy Germany.

Oh What a Tangled Web The Fed Weaves

In the quest to uncover distortions,

the most obvious place to look is the market for U.S. government debt. If the

goal is to impact pricing outcomes, what better place to get more bang for your

buck than tossing a wrench into the benchmark interest rate for global financial

assets, which also happens to be the funding source for the world’s largest

debtor. And this is precisely what has been occurring with the Fed’s unending

wave of extraordinary easing measures. Interest rates theoretically should be

set by the willingness of investors to hold government securities given the

sovereign’s debt profile, the country’s inflation rate, growth prospects, etc.

In reality, short-term interest rates are influenced by the Fed Funds rate,

which as we know, has been riveted to the floor at 0.25% through mid-2015. By sucking

up the (considerable) issuance of short-term Treasuries, the Fed is ensuring

distorted demand for the debt of a country with 100% gross debt to GDP, a

public sector on the ascendency and leadership in vapor lock as the country

approaches the 2013 fiscal cliff.

In the early days of the

financial crisis, when rates were initially cut to zero, the spread between

10-Year and 2-Year notes blew out to nearly 300 basis points (3%) as investors

used the prices of the 10-Year to register their expectation that the low Fed

Funds rate would ultimately lead to inflation. Such a relatively high yield on

the benchmark 10-Year would only further constrict credit flow in an anemic

economy (to those who could actually qualify for a loan). To mitigate this

signal, the Fed unleashed its torrent of quantitative easing, thus impacting

the prices of government paper all along the yield curve. The resulting

artificial demand for Treasuries (from the marginal buyer…the Fed) not only diminishes

the movements of the Treasury market as an effective gauge of economic health,

it also has sent shockwaves throughout the entire financial universe.

Another nifty tool in warping

sovereign debt markets is the regulatory preferences for putatively risk-free assets on a bank’s balance

sheet. As stated in our recent discussion on Financial Repression, there is a

glaring conflict of interest when regulators cajole banks into holding

government debt in the name of (hah!) safety. This practice is a component of

the international Basil III banking capital requirements and is displayed most

egregiously in Europe’s financial calamity. Who in their right mind would load

up their balance sheet with debt of teetering countries like Greece, Spain and

Portugal? Greek, Spanish and Portuguese banks, that’s who. As foreign investors

have (rightly) fled this garbage, local banks have stepped in to fill the vacuum,

thus helping governments avoid….for now….default. Banks are not doing this out

of magnanimity or national pride, but because the European Central Bank (ECB)

has shredded its rules and agreed to take junk government paper as collateral

thus providing life-saving liquidity to these banks (see the June posting on

Europe for further analysis of the toxic relationship between governments and

banks).

Currency War, Anyone?

Another market obviously affected

by central bank machinations is the currency market. Even on its best days, foreign

exchange markets fall short of “unfettered” status. Rather than currency values

being set by the demand for a country’s underlying goods, its growth prospects,

inflation outlook and interest rate differentials, FX prices are instead guided

by a cartel of central bankers and other authorities, using a range of tools.

In addition to policies such as the Fed’s previously described extraordinary

efforts to keep interest rates low, policy makers can effect exchange rates by

imposing trading ranges, limiting international purchases of domestic financial

instruments or directly intervening into markets by purchasing foreign currency

(paid for with the local flavor) in order to lower the value of the domestic

currency. Such initiatives are great for exports, but lousy for consumers as

they are pummeled with imported inflation, namely via commodities in the case

of American businesses and households.

As the pace of global growth

subsides and the competition among nations for export advantages heats up,

accusations of currency manipulation begin to fly. Claimants have plenty of evidence

to point to: China continues to keep the Renminbi’s trading range tight. Brazil

has implemented capital controls, and the United States continues to preach the

advantages of a strong dollar whose price is set by the market while it does everything

in its power to manipulate the hell of that process.

Bubbles Bubbles Everywhere

Price levels in other financial

markets are influenced not only by current central bank policy, but also by

other, often well-established, actions. The Fed has been explicit in its desire

to force yield-starved investors further out along the risk spectrum in search

of satisfactory returns. In normal times, if we can remember them, equity

markets are said to be driven by the three “E”s: earnings, economics and emotions. To that we can now add a

fourth: easing. The influence of policy

is evidenced by investors paying ever more attention to anticipating the

government’s next big market-moving initiative, rather than concentrating on fundamental

investment drivers. This reaction is also a component in increasing

correlations among risky assets, the so-called risk-on / risk-off trade.

During the commodities bull

market of the past decade, this asset class attracted investors not only as a component

of portfolio diversification and an inflation hedge, but also due to the

impressive yield several sectors were delivering. It should be no surprise then

that investors again sought to dial up their allocation to commodities as the

Fed ramped up its smorgasbord of easing. The proposition becomes all the more

enticing as low rates makes financing speculative positions with buckets of

borrowed money all the more affordable. In the long run, supply and demand may

indeed have the final say, but until then, artificially goosed demand for an

array of industrial inputs will put pressure on commuters’ wallets and the

income statements of businesses purchasing raw materials for fabrication and

energy for running factories and transporting wares.

Power Corrupts; Absolute Power Corrupts Absolutely

Rather than reserve all our ire

for the Fed and ECB, other financial markets are rife with distortions as well.

China….being China….has historically limited domestic retail investors stock

holdings to mainland-listed shares, while curtailing international players.

This winnowing of participants results in price distortions as investors

desiring equities exposure have no choice but to invest domestically. And they

have good reason to seek yield as the government sets deposit rates so low….to

benefit state-favored industrial borrowers in an example of another distorted

market, this time for credit….that in order to keep up with inflation, local

investors must seek exposure to risky assets. This is the same reason the

nation’s property market has experienced a bubble. Guess they have not heeded

the American lesson that real estate prices don’t only go up up up.

While Brazil is a free-market

bastion compared to China, it too is unafraid in providing a guiding hand in

certain sectors of the economy. One of which is the allocation of credit by the

government-linked Brazilian Development Bank. Gone are the days of rampant

Latin-American protectionism, expropriation (except in Venezuela and

Argentina), and industrial policy. But this entity still provides support to

inefficient enterprises that likely could neither attract private capital nor

compete on the global stage with leaner foreign competitors.

The Real Economy

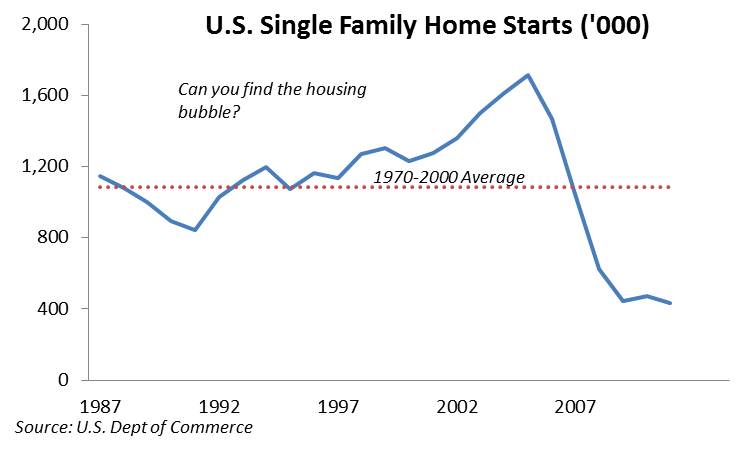

The extensions of credit

highlighted above illustrate that the real economy is not immune to market

distortions. The most obvious example of this is the U.S. housing market, both

in the run-up to, and in the aftermath of, the crisis. Lame-brained policies

created to bump up home ownership, along with the acquiescence of the securitization

market (the shadow banking system) as it churned out Frankenstein-bonds, artificially

increased the demand for housing, especially among market segments that had

previously been denied access to credit…as it turns out, many for good reason. After

the market’s monumental collapse, the federal government unleashed a barrage of

programs to suppress the price discovery mechanism needed to clear markets of

excess inventory and ultimately find equilibrium. Programs such as the first

time home buyers tax credit only pushed purchases forward by the few souls who

could still qualify for a mortgage. Loan modification programs and threats to

sue banks back to the stone-age should they dial up foreclosures only further cloud

market function. Cash for clunkers was a similar deal. It pushed forward sales

that would have occurred anyway, but did nothing to alter the long-term viability

of the auto market (which finally now is recovering…..thanks to time).

On everyone mind’s these days…especially

in context of tomorrow’s election…is the U.S. healthcare system. Yet even

before the Affordable Care Act was dreamed up, the market for health services

in America was far from free. The source of one of the main distortions is the

large share of services paid by third parties, mainly thanks to the tax preference

given to employer provided insurance. Any time there is little or no direct

cost to a product’s consumer, demand will inevitably spike and lead to a strain

on the system. This in turn has led to payers of health care…government and insurance

companies… to micromanage the system, which has blown everything up. Perhaps

more than in any other segment of the economy, the failures of U.S. healthcare

have been due to a lack of free market pricing mechanisms, not because of the supposed

iciness of the market. This issue is all the more relevant as the U.S. is on

the path to move towards a system, which if not a single-payer, at least will

have dramatically fewer providers than at present. So much for thousands of

transactions being the source of innovation.

The Green Dream

Perhaps the best way to provide

cover for manipulating a market is to proclaim a public good comes from doing

so. Until 2011 farm belt politicians threw their collective weight around to

ensure gasoline refiners blended corn-based ethanol into the end product. While

claiming the benefit of a green source of energy, they ensured foreign sources

of similar world-saving products, namely Brazilian cane-based ethanol, got

slapped with a nasty tariff. Artificial demand for their product and unintended

consequences in the form of a third of the nation’s corn crop being diverted to

ethanol plants rather than into animal feed, cereal boxes and Aunt Mable’s

cornbread. In the end, consumers paid the price. Other segments of the

alternative energy universe also provide fertile ground for authorities to

stoke demand for a product that otherwise would not be commercially viable. This

explains why countries with such notoriously drab weather such as Germany and

Japan are leaders in solar energy capacity.

Can We Practice What We Preach?

Price signals are supposed to

empower market participants with the information necessary to make informed

decisions. That process becomes more difficult when one cannot trust the

validity of the information presented. What’s worse, if the market is being

overtly twisted by a force such as policy makers, one cannot guarantee that the

measure applied will be reversed (or increased) thus potentially rendering

recently made transactions unprofitable. Who would want to commit capital in

such an environment? Given the above examples of financial market shenanigans,

imagine being a portfolio manager and having account not only for the intrinsic

value of various instruments, but also factor in how the whims of policy makers

may cause gritty fundamental analysis to be all for naught. Clearly in some circumstances market

intervention may be necessary, but even in these cases policy makers must

measure the costs and benefits, including the nebulous unintended consequences.

As many have said, the free market may certainly have its flaws, but it has

proven far more effective in meeting society’s needs….when actually allowed to

be free….than the competing systems championed in years past.

No comments:

Post a Comment